With this in mind, they’ll look for price action to consolidate, which typically signals that a breakout is imminent. ⭐ Learn about some of the most popular indices trading strategies you can use today. Before you start using a trading strategy, you need to have facts that confirm its profitability.

Scalping is an intraday trading strategy in which traders buy and sell currency with the goal of shaving small profits from each trade. In forex, scalping strategies are typically based on an ongoing analysis of price movement and a knowledge of the spread. Because swing trading demands quick action and close market oversight, it’s typically favored by day traders who are available to monitor changes in price momentum minute to minute.

As a result, we have no reason to believe our customers perform better or worse than traders as a whole. It’s common for new traders to trade strategies with loose definitions or missing some of the main components that every trading strategy MUST HAVE. Knowing when and how you plan to sell a security should be built into your trading strategy. Explore exit strategies, including 4 common ways to build one, so you’re prepared when it’s time to sell. Trading strategy creation is an important step during automated execution of trades. The trading strategy helps execute the trades systematically for making the outcomes favourable for the traders.

Commonly used are technical indicators, particular support/resistance levels, candlestick/chart patterns, or combinations of these. The trend trading strategies generate entry and exit conditions according to the trend of the stock. According to the trending trading strategy, an asset is bought during its uptrend and is shorted during the downtrend, assuming the price to continue in the direction of the trend. Momentum trading strategy is based on price trends and the direction they’re taking.

Event-based trading strategies

Without a well-planned strategy, you’re leaving yourself open to the whims of the market and your emotions. So, a momentum strategy may not work properly when market is not trending. At the same time, a mean reversion strategy may not perform the best when market is trending. Hence, you can combine momentum with mean reversion strategies to generate consistent returns. K-Means Clustering is a type of unsupervised machine learning that groups data on the basis of similarities.

Although a smaller position size curbs their profit margin, it ultimately protects them from suffering substantial losses. Trading the dips and surges of ranging markets can be a consistent and rewarding strategy. Because traders are looking to capitalize on the current trend rather than predicting it, there is also less inherent risk.

The choice of the risk-reward trade-off strongly depends on trader’s risk preferences. Often the performance is measured against a benchmark, the most common one is an Exchange-traded fund on a stock index. In the long term a strategy that acts according to Kelly criterion beats any other strategy. However, Kelly’s approach was heavily criticized by Paul Samuelson. Day Trading; The Day trading is done by professional traders; the day trading is the method of buying or selling within the same day.

From beginners to experts, all traders need to know a wide range of technical terms. You should now have a clear understanding of what a trading strategy is and how to build a playbook to clearly define your strategies. Every security has it’s own characteristics in terms of volatility, how it tends to trade through key levels, spread, liquidity, and so on. Here’s where you will outline the characteristics of the securities you plan to trade the strategy on.

We form an optimum strategy.

Therefore, in total 20 pips were collected with a scalping trading strategy. Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process. In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones.

The use of a Stop Loss, Take Profit order and Trailing Stop are risk management tools that can be utilized to help limit losses whilst locking in potential profits from open trades. Stop Loss, Take Profit, and Trailing Stop orders can be based on your daily trading targets, a maximum drawdown, or trade levels which can be programmed into an Expert Advisor. Swing trading is a more hands off trading strategy, focused on identifying upswings and downswings wherever the trader is able to. So while swing traders may make a handful of trades during a period, there may be days where they may not open a position at all.

- Trading strategies can be stress-tested under varying market conditions to measure consistency.

- IG International Limited receives services from other members of the IG Group including IG Markets Limited.

- You should consider whether you understand how Derivatives work and whether you can afford to take the high risk of losing your money.

Note the candle, which closed with a long bottom shadow on a splash of the maximum volume. The Open Interest indicator, first, fell to the mark of -6484, but the open interest again increased by the moment of the candle closing. This tells us that there was a wave of sells, on which a part of long positions left the market. A new buy wave took place immediately and this wave was accompanied with increase of the open interest. After a breakout, we observe not just increase of the price highs but also a shift of levels with a maximum concentration of volumes. Increase of levels with the maximum volume confirms the market interest in the price growth.

https://forex-trend.net/ is not easy, and certainly much more demanding than long-term investing. We recommend setting aside money for long-term appreciation, preferably in mutual funds. The above backtest of a trading strategy shows a rather poor strategy, even though the CAGR is decent. The drawdowns are big and it’s hard to trade a trading strategy like this in a live trading account. Unfortunately, many want to be day traders in the hope they can make money faster.

When you lose money on a trade, it doesn’t necessarily mean that you did something wrong or that your approach was flawed. Although technical analysis can help you manage risk and reward and inform your trading decisions, no analysis can predict the future with 100 percent certainty. Rather than scrapping your strategy each time the market moves against you, practice smart money management and be consistent. The more time you take to learn and practice a certain strategy, the more adept you’ll become at its execution. Being methodical in your approach will also give you a better understanding of what’s working and what’s not.

Take some time to understand the market you’re dealing with and determine what strategies are best suited to those conditions. In a grid trading strategy, traders create a web of stop orders above and below the current price. This “grid” of orders essentially ensures that, no matter what direction price moves, a corresponding order will be triggered.

Trading platforms

No matter your knowledge or trading experience, all trading strategies should be tested and understood first in a risk-free Demo environment prior to being traded with real money. The technical analysis covers a variety of techniques that use historical price data to interpret and try to forecast future price movements. Fundamental analysis is the process of using political, economic, and social factors to interpret the potential impacts these may have on the value of a country’s currency. As a beginner, focus on a maximum of one to two stocks during a session.

Without a trading strategy, trading becomes gambling for inducing adrenaline and not profit. That is why you cannot overestimate the importance of a trading strategy. The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

However, only when the proper context is applied to https://topforexnews.org/, do they become profitable. Machine learning trading strategies are best applied with the help of popular computer language Python. There is a Python package known as Scikit-learn, which is developed specifically for machine learning and features various classification, regression and clustering algorithms. ClassificationFor instance, the categories in the trading domain can be classified as entry position and exit position in any of the following markets – a stock, commodity, bond, derivative.

INFINOX Platforms Whatever your trading experience, we have the platform to take you to the next level. By employing a consistent strategy, you can identify tweaks to improve your results over time. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc.

Finale: Some advice before you embark on your trading career

Discover the range of markets and learn how they work – with IG Academy’s online course. Always do as much research as you can before entering the live markets and get your demo account to hone your skills. A reversal can occur in both directions, as it is simply a turning point in market sentiment. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. While a ‘bearish reversal’ indicates that the market is at the top of an uptrend and will likely become a downtrend.

If you think NFP is going to boost the dollar, you’d https://en.forexbrokerslist.site/ the pair. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market. For those with programming knowledge, backtesting the system using trading bots can be very handy. The reports that can be generated can reveal information about profit factors, average losses, wins and so forth.

A Complete Guide to Trading Strategies

Many traders could view this as a potentially important change in market sentiment. To distinguish between retracements and reversals, many traders will use a form of technical analysis called Fibonacci retracements . This principle dictates that a retracement will end once price reaches a maximum Fibonacci ratio of 61.8 percent. For this reason, many traders use this ratio of 61.8 percent to place profit-taking or stop-loss orders. Retracement traders who aim to profit on the break in the trend will also use the Fibonacci ratios of 38.2 percent and 50.0 percent as entry and/or profit-taking points.

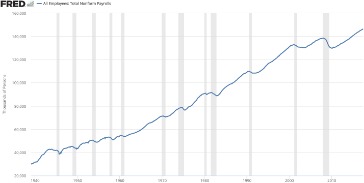

Day traders earn their title by focusing solely on intraday price movements and capitalizing on the volatility that occurs therein. These small market fluctuations are related to current supply and demand levels rather than fundamental market conditions. Of retail investor accounts lose money when trading CFDs with this provider. Do you want to make sure personally that the described strategy is efficient? Download ATAS. More than 500 stocks of American companies from NYSE and Nasdaq markets are presented in the platform. Try to find levels, where brokers forcibly close positions of regular traders.