Content

You are also responsible if a Purchaser reverses a payment by bank transfer, whether or not the reversal complies with the ACH Rules. WePay or the Bank may have tax reporting responsibilities in connection with the Service.

Also known as pre-authorized debits, withdrawals, or ACH payments, this is a convenient way to pay recurring bills. Many utilities, insurance companies, and others that bill you regularly offer this option. I had about 100 dollars left, i bought a book for 139 dollars, and then i went to an atm and transferred 50 dollars to my checking. I shouldve gone to the atm first, i know, but i thought that it wouldnt overdraft until after it actually went through . Our top-rated app offers powerful features you’ll love to use, such as the ability to send money to friends, securely log in with just your fingerprint. When you send money to friends or family, it won’t cost you any extra money for the transaction.1 Which is good, because there are way better things to spend money on, like houseplants…or babysitters. You can also choose from a variety of automated payment options, including payment to arrive on due date, payment made upon the receipt of the eBill and payment to arrive before the due date based on the number of days you choose.

Amendment Of Agreement

Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. Merchants are monitored by payment processors for their chargeback ratio. This ratio can indicate levels of risk for fraud or poor business conduct. Visa requires due diligence and that merchants always have a legitimate reason for forcing a payment. Multiple chargebacks can result in a merchant being deemed a high risk, which can lead to the revocation of card processing privileges. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising.

Standard Overdraft Practice Overdraft Services Chase.com – Chase News & Stories

Standard Overdraft Practice Overdraft Services Chase.com.

Posted: Tue, 18 Jul 2017 04:58:37 GMT [source]

Access your bank account or open a bank account online. Bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches. If your debit card transaction was authorized, when there was a sufficient available balance in your account. Everyday debit card transactions, such as grocery purchases, gasoline or dining out. I’m really confused and just waiting for the mail to come by if it ever comes. I have no money in my checking yet i have another paycheck i have’t deposited yet .

Enjoy Zero Fees With A Cheese Debit Card

To set up and schedule payments to your Wells Fargo credit account from another financial institution, select Add Non-Wells Fargo Accounts on the Transfer Money screen, and follow the instructions. Transfers completed on non-business days will be available at the next nightly processing. Transfers completed before 8 PM Pacific Time on a business day will be available that day. Transfers completed after 8 PM Pacific Time on a business day will appear as “pending,” but will be available to pay your transactions that night as long as they are completed prior to our nightly processing . Initially the delivery speed is 2 business days for a transfer from your Wells Fargo account to your account at another financial institution, and 3 business days for a transfer from your account at another financial institution to your Wells Fargo account. Chase’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you’re about to visit. Please review its terms, privacy and security policies to see how they apply to you.

- Primarily, you should look at when you need to send or receive the money by, how much money you need to send, and whether you’ll have to pay any fees.

- A credit memo is a posting transaction that can be applied to a customer’s invoice as a payment or reduction.

- Stop payment is only available if recipient transaction is sent using standard speeds.

- You can always ask the bank nicely to refund the fee if you promise to be good and maybe they will.

- The Service supports most domestic and international credit, debit, prepaid or gift cards with a Visa, MasterCard, American Express or Discover logo.

- Select the account you want to transfer money from.

Neither WePay nor the Bank guarantees the security, sequence, timeliness, accuracy or completeness of any service, data or technology, or access to any service or technology. You agree this Agreement is for commercial services and the Uniform Commercial Code does not apply to the Service. We or the Platform may terminate this Agreement and close your Account for any reason or no reason at any time upon notice to you. You are responsible for determining any and all taxes assessed, incurred, or required to be collected, paid, or withheld, in connection with your use of the Service. You are solely responsible for collecting, withholding, reporting and remitting any taxes to the appropriate tax authority.

How Do I Schedule A Transfer?

What you can do is call your bank and ask them if they’ll do a one-time reversal of the charge. I know that if my account’s been clean for a year or so, Wachovia will do that on occasion. If you lose your debit card, freeze it to help prevent unwanted purchases or withdrawals. If you find your card later, unfreeze it to resume normal activity. Also, click TOOLS, Account List and tell us what shows in the “Transactions Download” column adjacent to this checking account. Acting responsibly in regards to your account is going to make the bank’s employees more inclined to help you if this causes an issue later with the payment of a check or ACH. Sign in to Online Banking and select the Bill Pay navigation tab.

- At the timely request of a party, the arbitrator will provide a written opinion explaining his/her award.

- Claims will be resolved pursuant to this Arbitration Agreement and the selected organization’s rules in effect when the Claim is filed, except where those rules conflict with this Arbitration Agreement.

- Any funds that the Bank holds for you at the time of closing, less any applicable fees and other liabilities, will be settled to you in accordance with Section 12, Settlement Schedule, and Section 13 Reserve, above.

- You can make recurring deposits into your DCU checking or savings account or make recurring DCU loan payments.

- If you send money to someone who isn’t enrolled with Zelle, they’ll receive a notification prompting them to enroll.

- Any notes you enter will be displayed in your transaction history online, and on your bank statement.

As the name suggests, it’s a feature that allows you to ensure that if you try to complete a transaction and don’t have sufficient funds, you won’t be charged any overdraft fee. Usually, when you use your Chase debit card, you’re not charged to use it because it’s withdrawing funds you actually have in your checking account. It’s the digital way of paying with cash, and because the bank knows you have those funds, they don’t charge you (unless it’s an international transaction). Contact the company and inquire if the service is available.

So I Just Lost All Money Due To A “debit Memo?”

In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. An eBill arrives from a biller into your Bill Pay account service the same way a paper bill arrives from a biller into your mailbox. Bill Pay allows you to view all your eBills—as well as account balances, transactions and statement information—in one convenient place. You can also set up email notifications for when a new eBill arrives in your Bill Pay account.

WePay or the Platform may instruct the Bank to deliver or hold any funds or any information as required under such Legal Order. Neither WePay, the Bank nor the Platform is responsible for any losses that you may incur as a result of our response or compliance with a Legal Order. There are several ways to transfer money at financial services firms. The two most common are bank wires debit memo and electronic funds transfers , but understanding how each of these transfer methods work and why you might choose one over the other can be challenging. Here’s what you should consider before you make your next transfer. Make sure you deduct these payments from the balance in your check register in advance of the actual payment date to avoid over-drafting your account.

When A Fee Wont Be Charged

However, large checks ($5,000-plus), redeposited checks, and those going into frequently overdrafted accounts will often have longer hold times. This also applies to checks that the bank has “reasonable doubt” about – that is, if they doubt the funds will clear. The bank should notify you if they have placed your account on hold.

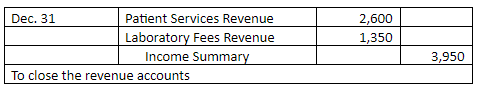

How does a credit memo work?

A credit memo, or credit memorandum, is sent to a buyer from a seller. … A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item. When a seller issues a credit memo, it’s put toward the existing balance on a buyer’s account to reduce the total.

A user who opens an Account must be eighteen years of age or older. You may open an Account for an entity only if it is legitimate and you have the authority to enter into this Agreement on its behalf.

Are There Other Options For Transferring Money?

Returning it likely wouldn’t do much of anything; once the purchase is made, the overdraft fee is going to go through. If Chase gives you back your ODP fee it is not because Chase or the book seller did anything wrong, it sounds like you are the one abusing the system here and now you want Chase to pay for your lazy banking attitude.

Chase offers a notification service that you can enable that will allow you to receive an SMS or email when your Chase bank account balance goes below a certain level. This is helpful in letting you know where you’re at so you know how much you can and cannot spend. As long as you have both a savings and a checking account, you’ll be able to sign up. This will prevent you from having to pay the $34 fee in the future. You choose which DCU account the money goes into and which account at your other financial institution the money will be transferred from. It’s free at DCU, but the other institution may charge a fee. Our online banking gives you the tools to manage your accounts whenever you want, keep a close eye on your money and monitor for fraud.

See Whos Using Zelle®

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. For a better experience, download the Chase app for your iPhone or Android.

- But, with all of the common monthly banking fees people pay for, it’s best to learn how to avoid losing even more money on overdraft fees.

- For more information, see the developer’s privacy policy.

- Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices.

- The memos are typically sent out to bank customers along with their monthly bank statements and the debit memorandum is noted by a negative sign next to the charge.

- Each of the Card Networks is a third-party beneficiary of this Agreement and has beneficiary rights, but not obligations, and may enforce this Agreement against you.

- However, it is important to remember that the transfer of money between banks does not happen instantaneously.

Add a contact or select the email or mobile phone number of an existing contact. When adding a contact, enter the name and email or U.S. mobile phone number of the friend or family member you want to send money to. You must have a bank account in the U.S., as well as a valid email address or U.S. mobile phone number to enroll in Zelle. •Simplify your daily business activities by searching for specific transactions, viewing reports, processing voids/refunds and keeping up with your merchant account – all from your smartphone or tablet. The next day, the 22nd, I stopped by an ATM to check my balance, because I couldn’t remember how much the bank was allowing me to have until the hold could be removed from my deposit. Delighted, I took out the $300 I needed to pay my electric bill from the ATM and went on my way. Johanna deposited a financial aid check from her university into her Chase checking account.

Most of the time, if you don’t have many overdrafts on your account, they’ll give you a free pass the first time. This requires you to have both a checking and a savings account with Chase, and it requires that you have enough money in your savings account to cover the cost of the transaction. Stop Payment Request(.pdf format) – Please use this form to place a stop payment on your account for both checks and ACH electronic items.

This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. You help support CreditDonkey by reading our website and using our links. Choose the “To” and “From” accounts, pick the date and enter the amount you’d like to transfer. Select the account you want to transfer money from. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.

There is no limit to the number of EFTs you can submit per business day. The minimum amount for each EFT is $10, and the maximum amount per day is $100,000 for withdrawals, and $250,000 for deposits. If you want to have a large transaction completed more quickly, you may ask for a direct deposit or that the money be wired directly to you instead of receiving a check. Direct Deposit of Federal Recurring Payments(.pdf format) – Use this form to have DCU set up direct deposit of your Social Security or federal pension to your DCU account. We provide a range of free services and ways to making banking easier.

It's so cool when @Chase randomly takes $265.80 out of my account for something called "Memo Debit". Really fucking cool.

— bruce. (@BruChristopher) October 22, 2015